Student Loan Debt in America: A Complete Guide Student loan debt in America has reached a critical point, affecting millions of borrowers and reshaping the nation’s financial landscape. With over 45 million Americans holding student loans and the total debt surpassing $1.7 trillion, this crisis is more than just a financial burden—it’s a societal challenge. In this comprehensive guide, we’ll explore the current state of student loan debt in America, its far-reaching impacts, and actionable strategies to help borrowers manage and overcome this crisis. Whether you’re a recent graduate, a parent, or simply curious about the issue, this guide will provide valuable insights and practical advice.

Table of Contents

The Current American Student Loan Debt Situation

The total amount of debt incurred by American students

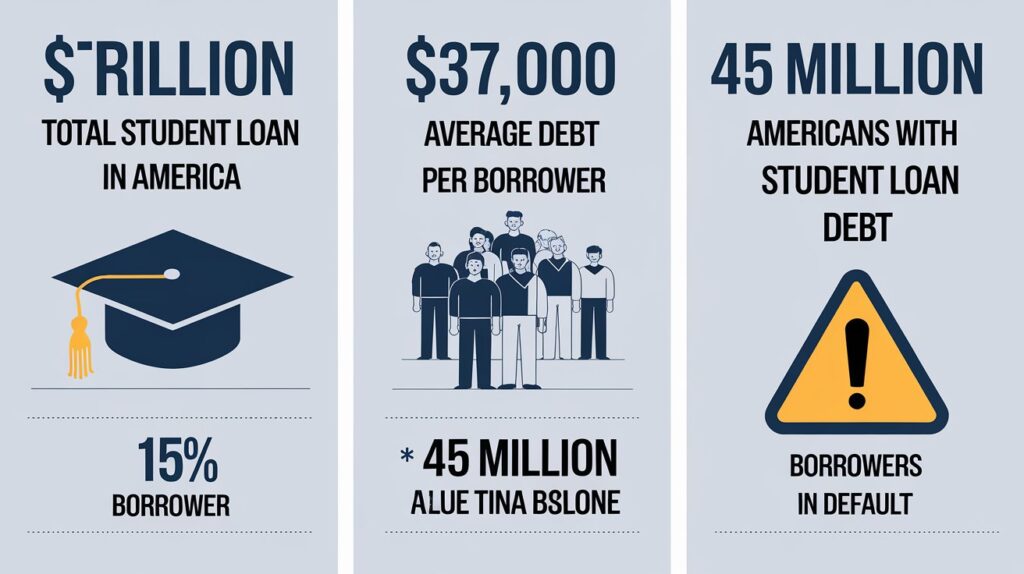

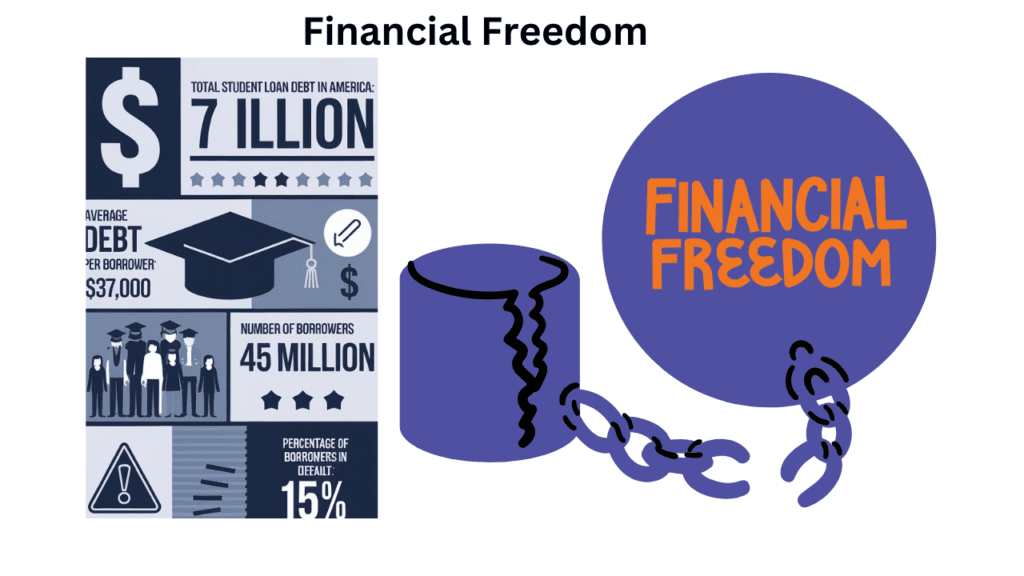

As of 2024, the total student loan debt in America has exceeded $1.7 trillion, making it the second-largest category of consumer debt after mortgages. This massive debt is primarily held by the federal government, with private lenders accounting for a smaller portion.

The total average amount of student loan debt in the US

The average student loan debt in America for recent graduates is approximately $37,000. However, this figure varies widely depending on factors like the type of degree, institution, and state. For example:

- Bachelor’s Degree Holders: Typically owe between $20,000 and $40,000.

- Advanced Degree Holders: often owe $100,000 or more, especially in fields like medicine and law.

Why is Student Loan Debt a Problem?

Impact on Individuals

Student loan debt in America isn’t just a financial issue—it’s a life-altering burden. Here’s how it affects borrowers:

Delayed Milestones: Many graduates postpone buying homes, starting families, or saving for retirement due to their debt.

Mental Health Struggles: The stress of repayment can lead to anxiety, depression, and other mental health issues.

Limited Career Choices: Some borrowers feel forced to prioritize higher-paying jobs over their passions to manage their loans.

Impact on the Economy

The ripple effects of student loan debt in America extend beyond individuals. High debt levels can:

- Slow economic growth by cutting back on consumer expenditure.

- Limit entrepreneurship, as fewer people can afford to start businesses.

- Exacerbate wealth inequality, particularly for minority communities.

Key Statistics on Student Loan Debt in America

Here are some eye-opening statistics on student loan debt in America:

- The number of Americans with student loan debt exceeds 45 million.

- The average student loan debt in the USA has increased by 20% over the past decade.

- Student loan debt in America 2022 to 2025 is expected to grow as tuition costs continue to rise.

- Approximately 15% of borrowers are in default, facing severe financial consequences

Who Has Student Loan Debt in America?

Student loan debt affects a diverse group of Americans, including:

- Recent graduates with bachelor’s degrees.

- Professionals with advanced degrees, such as doctors and lawyers.

- Parents who took out loans to support their children’s education.

- Older adults who returned to school to advance their careers.

How to Manage Student Loan Debt in America

1. Explore Repayment Options

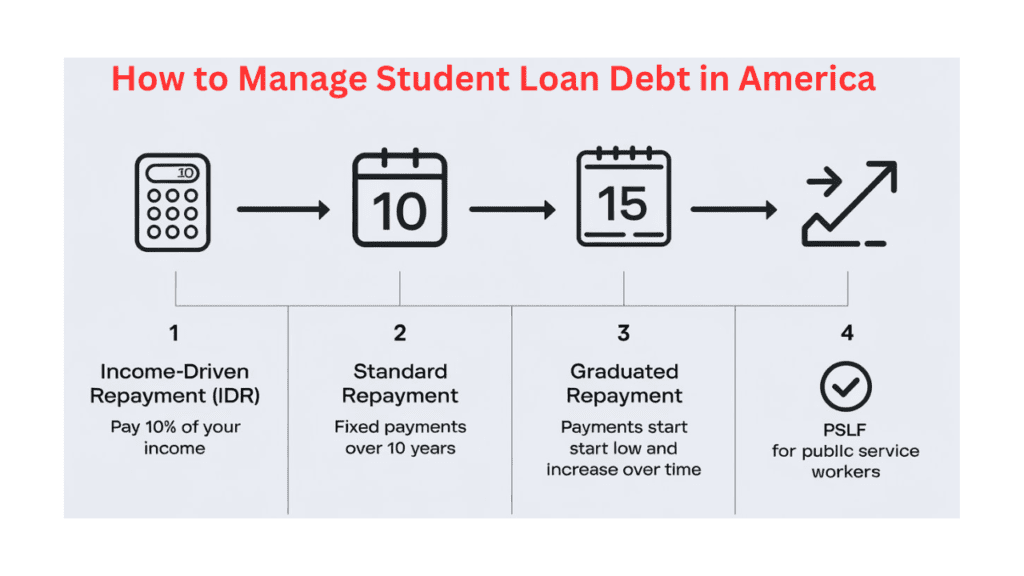

A number of repayment schemes are available for federal loans, including:

- Income-Driven Repayment (IDR): Caps monthly payments at a percentage of your income.

- Standard Repayment: Fixed payments for 10 years.

- Graduated Repayment: Over time, payments rise from their initial low level.

2. Consider Loan Forgiveness Programs

Programs like Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness can help eligible borrowers have their loans forgiven after meeting specific requirements.

3. Refinance Your Loans

Refinancing can lower your interest rate and monthly payments, but it’s important to weigh the pros and cons, especially if you have federal loans.

4. Create a Budget

Track your income and expenses to allocate more funds toward loan repayment. Reducing wasteful spending can help you save more money for quicker debt repayment.

America’s Student Loan Debt Future :

The current student loan debt in America is a complex issue with no easy solutions. But there is promise for the future:

- Policy Changes: Ongoing debates about studenthttps://net-stories.com/top-10-universities-in-usa/ loan forgiveness and tuition-free college could lead to significant reforms.

- Economic Recovery As the economy improves, more borrowers may find stable employment and higher wages to manage their debt.

- Increased Awareness More people are advocating for transparency in lending and affordable education options.

Conclusion: How you can Take Control of Your Student Loan Debt

Student loan debt in America is a daunting challenge, but it’s not insurmountable. By understanding the average student loan debt in America, exploring repayment options, and staying informed about policy changes, you can take steps toward financial freedom. Remember, you’re not alone in this journey—millions of Americans are navigating the same path.

If this content was useful to you, please forward it to others. Together, we can tackle the student loan debt crisis in America and build a brighter financial future.