How to Pay Off Student Loans: Student loans can feel like a heavy burden, but with the right strategies, you can pay them off faster and save thousands of dollars in interest. Whether you’re wondering how to pay off $50k in student loans or looking for tips to pay off student loans more easily, this guide will provide actionable steps to help you achieve financial freedom. Let’s dive into the best ways to tackle your student loan debt in 2025 and beyond.

Table of Contents

Why it is Important to Pay Off Student Loans Quickly

Student loans can linger for decades if not managed properly. The average borrower takes 20 years to pay off their debt, and some even stretch it to 30 years. By learning How to quickly pay off student loans, you can:

- Save money on interest.

- Improve your credit score.

- Free up income for other financial goals like buying a home or investing.

Whether you’re dealing with $50k in student loans or $100k in student loans, these strategies will help you take control of your debt.

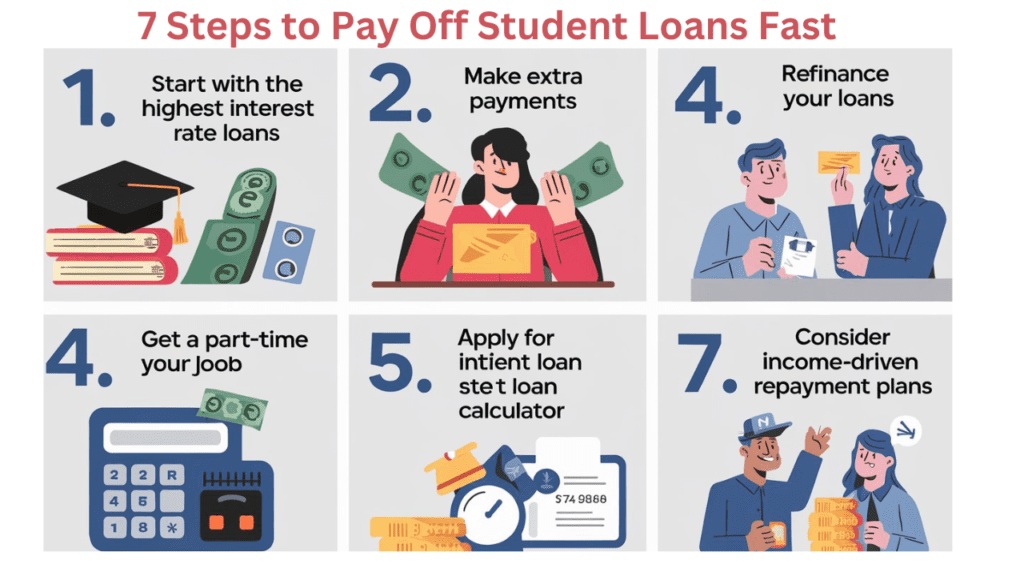

7 Proven Strategies to Pay Off Student Loans Fast in 2025

1. Make a spending plan and stick to it.

The first step to paying off student loans is understanding your finances. Use budgeting tools like Mint or NAB to track your income and expenses. Allocate a portion of your income specifically for loan payments.

Pro Tip: Cut unnecessary expenses like subscriptions or dining out, and redirect that money toward your loans.

2. Explore Loan Forgiveness Programs

If you have federal student loans, you may qualify for loan forgiveness programs like:

- Public Service Loan Forgiveness (PSLF): For government or nonprofit employees.

- Teacher Loan Forgiveness: In low-income schools, for teachers..

- Income-Driven Repayment (IDR) Forgiveness: After payments for 20 to 25 years.

Check the eligibility requirements and apply if you qualify.

3. Refinance Your Student Loans

Refinancing can help you secure a lower interest rate, especially if your credit score has improved since you took out the loan. This is one of the the best ways to pay off student loans with different interest rates.

Caution: Refinancing federal loans into private loans means losing access to federal benefits like loan forgiveness.

4. Make Extra Payments

Paying more than the minimum amount due can significantly reduce your loan term and interest costs. For example, if you have $50k in student loans, adding an extra $100 to your monthly payment can save you thousands over time.

Tip Specify that extra payments go toward the principal balance, not future payments.

5. Use the Debt Snowball or Avalanche Method

- Debt Snowball: Pay off the smallest loan first, then move to the next. This builds momentum.

- Debt Avalanche: Focus on the loan with the highest interest rate first to save money.

Select the approach that best suits your personality and financial objectives.

6. Increase Your Income

Try to increase your income in the following ways:

- Taking on a side hustle (freelancing, tutoring, etc.).

- asking for a pay boost at work.

- Selling unused items online.

Use the extra income to make larger loan payments.

7. Automate Your Payments

Set up automated payments so you never forget a deadline. Many lenders offer interest rate discounts for enrolling in autopay.

How to Repay Student Loans Totaling $100,000

Paying off $100k in student loans may seem daunting, but it’s achievable with discipline and the right strategies. Here’s how:

- Refinance: Lower your interest rate to reduce the total cost.

- Aggressive Payments: Allocate as much income as possible toward your loans.

- Side Hustles: Use additional income to make extra payments.

- Budgeting: Cut expenses and prioritize loan repayment.

How Student Loans Can Be Repaid in Five Years

If you’re aiming to pay off your loans in 5 years, follow these steps:

- Calculate Your Monthly Payment: Use a student loan calculator to determine how much you need to pay monthly.

- Increase Payments: Allocate bonuses, tax refunds, or side hustle income toward your loans.

- Avoid Lifestyle Inflation: As your income grows, resist the urge to spend more and instead put the extra money toward your loans.

Advice for Easier Student Loan Repayment

- Set Goals: Break your repayment journey into smaller milestones.

- Celebrate Wins: Reward yourself when you hit a goal, like paying off $10k.

- Stay Motivated: Join online communities like Reddit (e.g., how to pay off student loans fast Reddit) for support and advice.

How to Reduce Your Loan’s Total Cost

- Pay Interest While in School: Prevent interest from capitalizing.

- Choose the Right Repayment Plan: Opt for plans that align with your financial situation.

- Avoid Default: Stay on top of payments to avoid penalties and fees.

Final Thoughts

Paying off student loans doesn’t have to be overwhelming. By following these strategies—whether you’re tackling $50k in student loans or $100k in student loans—you can take control of your debt and achieve financial freedom. Start today, and remember: every extra payment brings you one step closer to being debt-free.

Author: allykazmi