Personal finance is heavily influenced by your behavior. It is often said that managing personal finances is 20% knowledge and 80% behavior. Your spending habits, saving strategies, and mindset directly impact your financial health. If you want to achieve financial success, understanding why personal finance depends on your behavior is essential. Let’s explore this topic in-depth Personal Finance Behavior.

Table of Contents

The Role of Behavior in Personal Finance

Your financial behavior—such as budgeting, saving, and investing—is the cornerstone of your financial stability. Even with all the financial knowledge in the world, it’s your actions that truly matter. For instance, the simple principle of “spend less than you make” is easy to understand but difficult to practice. This behavioral gap is why many individuals face financial difficulties.

According to data from the first quarter of 2023, around 30% of Americans reported financial struggles. While this number represents a 19% improvement from late 2022, it highlights the importance of behavioral changes in achieving financial stability.

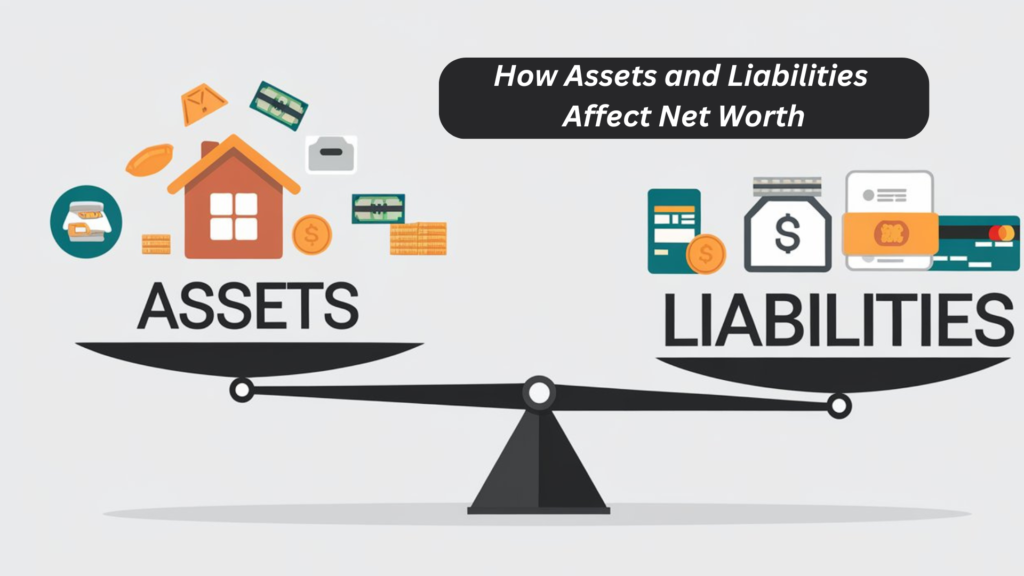

How Assets and Liabilities Affect Net Worth

Your behavior determines whether you accumulate assets or liabilities, which directly impacts your net worth. Let’s break this down:

- Assets: These are items of financial value that you own, such as savings, investments, and real estate.

- Liabilities: These are debts and obligations, such as credit card debt, student loans, or mortgages.

- Net Worth: Calculated by subtracting liabilities from assets, net worth measures your financial health.

By adopting disciplined spending and saving behaviors, you can reduce liabilities and increase assets, boosting your net worth over time.

What is Financial Literacy?

The ability to comprehend and successfully handle personal finances is referred to as financial literacy. It includes skills like budgeting, saving, investing, and debt management. While knowledge is important, financial literacy is only effective when paired with positive financial behaviors. For example, knowing the benefits of an emergency fund is useless unless you consistently save money to create one.

The Five Foundations of Personal Finance Behavior

The five foundations of personal finance provide a practical framework for financial stability:

- Save a $500 emergency fund.

- Use the debt snowball strategy to pay off all of your debt.

- Pay cash for your car.

- Pay cash for college.

- Build wealth and give generously.

These steps emphasize actionable behaviors. Building an emergency fund or paying off debt requires consistent saving and mindful spending, reinforcing the link between personal finance and behavior.

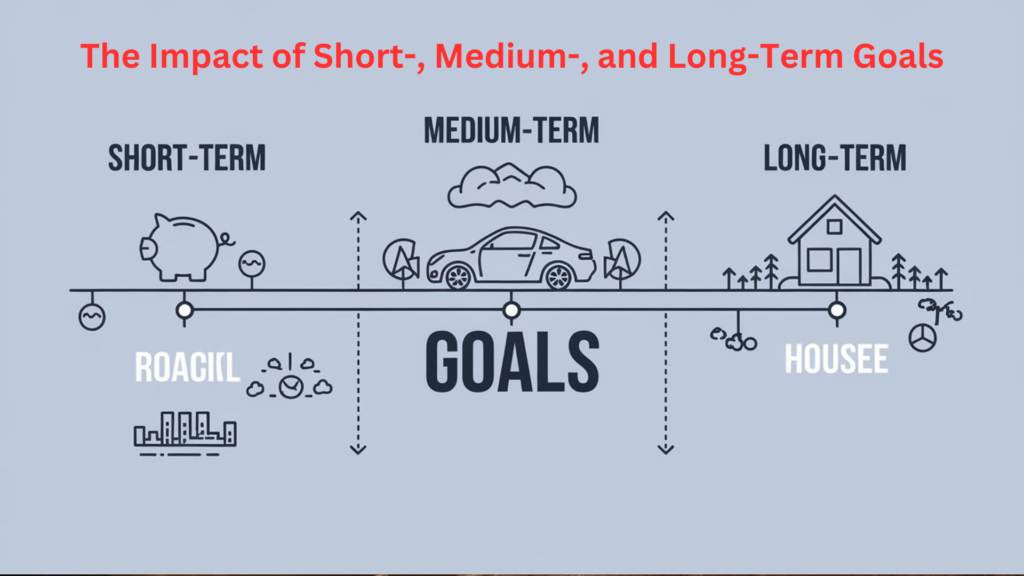

The Impact of Short-, Medium-, and Long-Term Goals

Financial goals can be categorized as short-term, medium-term, or long-term. Each requires a different approach and level of discipline:

- Short-term goals: Achievable within a year, such as saving for a vacation or paying off a small debt.

- Medium-term goals: Take 1-5 years, like saving for a car or building an emergency fund.

- Long-term goals: Span over five years, such as saving for retirement or buying a home.

Your behavior influences whether these goals are met. For example, impulsive spending can derail short-term goals, while lack of planning can jeopardize long-term objectives.

Why Does Your Behavior Affect Your Personal Finances?

Your behavior—such as how you budget, save, and invest—determines your financial health. For example:

- Budgeting: A disciplined budget helps you avoid overspending.

- Saving: Regular contributions to savings accounts build financial security.

- Investing: Smart investing behaviors grow your wealth over time.

By focusing on positive financial behaviors, you can improve your overall financial well-being.

Understanding Living Paycheck to Paycheck

Living paycheck to paycheck means relying entirely on your next paycheck to cover expenses. This lifestyle leaves no room for savings or unexpected expenses, increasing financial stress. Breaking free requires adopting better financial habits, such as:

- Creating a budget.

- Reducing discretionary spending.

- Building an emergency fund.

The Psychology Behind Spending and Saving

Behavioral economics shows that emotions and biases influence financial decisions:

- Emotional Spending: Buying items to cope with stress or boredom can derail financial goals.

- Money Scripts: Deep-seated beliefs about money shape how we manage it.

- Behavioral Biases It can be lead to poor financial decisions.

Addressing these psychological factors is key to improving financial habits.

Behavioral Strategies for Financial Success

Here are actionable strategies to improve your financial behavior:

- Set Clear Goals: Define short-, medium-, and long-term objectives.

- Track Your Spending: Use budgeting apps to monitor expenses.

- Delay Impulsive Purchases: Follow the 48-hour rule before buying non-essentials.

- Automate Savings: Set up automatic transfers to savings accounts.

- Educate Yourself: Continuously learn about personal finance.

- Seek Accountability: Share goals with a trusted friend or advisor.

The Benefits of Healthy Financial Behavior

Positive financial habits lead to numerous benefits, including:

- Reduced Financial Stress: Better habits provide peace of mind.

- Increased Savings: Disciplined saving creates financial security.

- Improved Net Worth: Managing assets and liabilities boosts financial health.

- Achieving Financial Goals: Consistent behavior ensures long-term success.

Conclusion

Personal finance is only 20% knowledge and 80% activity. You’re spending, saving, and investing habits directly impact your financial health. By understanding concepts like financial literacy, the five foundations, and the psychology of money, you can make smarter financial decisions. Whether setting goals or breaking free from living paycheck to paycheck, behavior is the key to financial success. Start small, stay consistent, and watch your financial future transform for the better.

You can visit our web-story and enjoy the story. for web story please click here. webstore

Author: allykazmi